What Does Carbon Credit Exchange Mean?

Carbon Credit Exchange Mean

A carbon credit is an asset that is made up of a metric ton of CO2 emissions removed or avoided. This credit can be used by a company, an individual, or even an investment fund. They are also called allowances or credits.

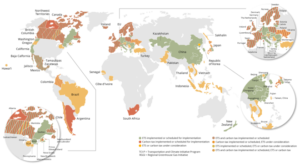

The value of carbon credit exchange depends on a number of factors. The volume of the credits being traded and the geographic location of the project can have an impact on the price. But the underlying reason for carbon credits is to reduce greenhouse gas (GHG) emissions.

If a factory produces 100,000 tonnes of greenhouse gases a year, it will need to purchase credits to offset its emissions. The market for these credits is called the voluntary carbon market, and they are available to every sector of the economy. It can be part of an industry wide scheme or can be a stand-alone market. The price of carbon credits varies, but it is typically lower than $40-$80 per metric ton of carbon dioxide.

What Does Carbon Credit Exchange Mean?

The value of a carbon credit varies depending on the size of the project, its geographical location and its delivery time. If a community-based project is localized and has a shorter delivery time, its value may be higher than a larger-scale industrial project.

There are several types of projects that can issue carbon credits, including offsets, offsets by companies, and certified emission reduction (CER) projects. A carbon project can be created by the national government or a third-party organization. The project is subject to specific regulations and must be in compliance with the jurisdiction’s legal requirements.

A carbon exchange is a marketplace that allows buyers and sellers to exchange carbon credits in real-time. It can be used by investors, traders, brokers, and institutional investors. It is built with security, speed, and scale in mind.

The market for carbon credits is growing rapidly. This is primarily because of the continued focus on reducing GHGs. This is driven by the Paris Climate Accord, which aims to cut global temperatures by two degrees Celsius. In addition, more industry sectors are establishing net-zero targets. They are looking for ways to hedge financial risks of the energy transition. The value of carbon credits is also increasing.

As more and more industries adopt the voluntary carbon market, the market for carbon credits is expected to grow at more than three percent a year. However, the market for carbon credits is not without flaws.

Some of these flaws include the lack of homogeneity, a lack of secondary market, and the lack of supplementarity. Using these flaws, the market for carbon credits can be difficult to establish. It is a complicated process, and the price for carbon is not easily determined.

In some countries, such as the United Kingdom, allowances are issued for free to the country’s existing businesses. These allowances trade in the international market at the prevailing market rate. This is a way to offset the financial impact of the cap-and-trade system.