Carbon Emission Credits Trading

Carbon Emission Credits

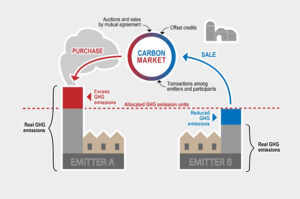

Carbon emission credits trading is an emerging industry in the world. It offers companies a way to offset the emissions they produce. In turn, it can help reduce economic inequality and improve water quality. A number of industry sectors, including the electricity sector, have already embraced this voluntary carbon market.

However, the market is still fragmented. There are many factors that affect the prices of carbon credits. The type of projects underlying the credits, their location and delivery time, and the volume of trades all contribute to the price. For example, a project that uses a more advanced form of greenhouse gas removal such as carbon trading Capture and Storage (CCS) can trade at a premium to a project that merely removes CO2 from the air.

Some of the largest purchasers of carbon credits include oil and gas majors, technology companies, and airlines. These companies are looking for a way to hedge the financial risks associated with an energy transition. They are also pledging to limit their emissions.

Carbon Emission Credits Trading

As more and more businesses look for ways to minimize their carbon footprints, the voluntary carbon market is becoming more attractive. But a lack of knowledge on how the system works has kept a lot of potential participants away. What’s more, putting a price on carbon is not an easy task.

In the United States, the Environmental Protection Agency (EPA) has begun to pursue standards under the Clean Air Act. Under this scheme, trading institutions are required to establish a risk reserve system fund to cover losses incurred by unforeseen events. This is necessary for a carbon market to function properly.

To participate in the voluntary carbon market, companies must be aware of the rules. This includes having a clear understanding of the types of projects that can be certified. Often, industrial projects are larger and have more easily verified GHG offset potential. Community-based projects are typically localized and generate more co-benefits, and may trade at a premium to industrial projects.

Companies must also be aware of the price of the credit they want to buy. This can be determined by the volume of trades that take place over a particular period of time. Additionally, it is important to know the vintage of the credits. Credits that have been retired will no longer be traded.

Some companies have created their own carbon market, and others have standardized their products to ensure basic specifications are met. For instance, the Shanghai Environment and Energy Exchange (SEEE) releases information about the trading day, including the average opening price, the number of trades, and the overall price that was traded.

The C-ETS also plays an important role in supporting the carbon market, as it provides four data systems to track trading activity. In the first week of the market’s launch, 4.1 million tonnes of carbon allowances were traded. The Ministry of Ecology and Environment (MEE) has also introduced a number of regulations on the trading practices of the C-ETS.