Debt Purchase Companies 101 – The Best Practices of Debt Purchase Companies

Debt Purchase Companies 101

A comprehensive report by the DBA International has identified several best practices of debt purchase companies. These recommendations are meant to protect the rights of alleged consumers and the integrity of the courts. Among the most important recommendations is that courts not issue default judgments against debt buyers. New York State has implemented rules to prevent such judgments, and these rules should be incorporated into state laws. To learn more about these best practices, visit the DBA International website.

The first rule is that a debt purchasing companies should use lawsuits to collect their money. It should be based on a legitimate claim and be supported by credible evidence. Additionally, the company should give the borrower sufficient notice so that they do not risk losing their property or assets. In addition, the lawsuits should follow legal norms. If not, you should look elsewhere. In short, debt purchase companies 101 is essential. There is a lot of information out there, so be sure to read up on each of them.

If you have a delinquent debt, a debt buying company will have more flexibility than your original lender. This is because the debt was acquired at a discount as low as pennies on the dollar. Even if you cannot afford the monthly payments, you may find yourself paying small amounts to the company. And this is exactly what you’ll want to do, too. It’s a win-win situation for the borrower, and for the company.

Debt Purchase Companies 101 – The Best Practices of Debt Purchase Companies

Lastly, a debt buying company should ensure its lawsuits are based on legitimate claims, with reliable evidence. These lawsuits should be filed properly, with adequate notice given to the debtor. Also, it should be noted that these debt purchasing companies should always follow the law. Having the correct paperwork in place will help you make a decision on whether a debt purchase company is right for you. And the right way to deal with a debt purchase company is to be sure the entire transaction is fair and that there are no hidden costs.

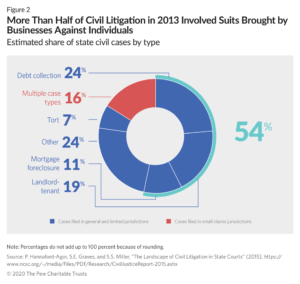

Many large debt buying companies use the courts to secure their financial returns. In 2014, Encore Capital, for example, earned $610 million through lawsuits against consumers. Meanwhile, Portfolio Recovery Associates earned almost $1 billion through legal collections. This means that the industry is a highly lucrative business. It pays pennies on the dollar to purchase a $10,000 debt. The companies pay their clients for these services. They may offer a wide range of services, and the benefits are often substantial.

A debt purchase company should be willing to file a lawsuit if necessary. This type of lawsuit is often the best option for a debtor who cannot afford to pay his or her bills. A law firm should also be willing to work with the debtor to settle the lawsuits in any way possible. It should be transparent when dealing with a company. A large company with transparent procedures will make it easier for the debtor to pay.